How the Ethereum Merge has affected miners

Since the completion of Ethereum’s merge and transition to Proof of Stake consensus on September 15, GPU-mining cryptocurrency has taken a massive hit. With Ethereum now unable to be mined, miners are transitioning to alternative Proof of Work cryptocurrencies such as Conflux, SERO, and Flux.

Additionally, much to the pleasure of the PC-building community, graphics card prices have subsequently tanked as used mining GPUs flood the market, leaving many miners the option to either sell at a loss or continue hashing on the cards they already own.

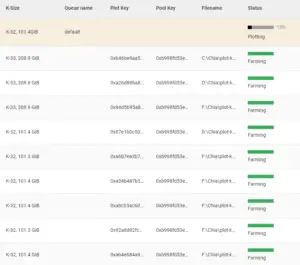

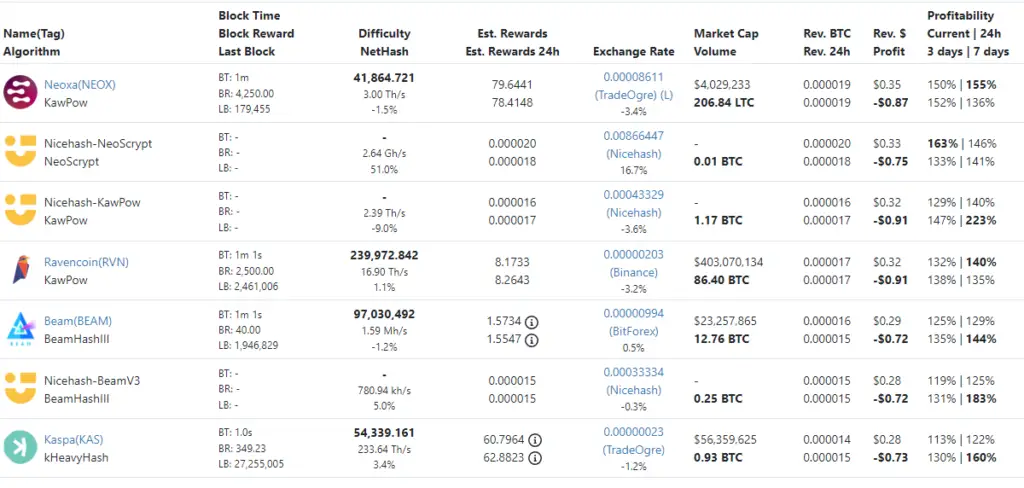

Whether you were a large-scale ETH miner or just a hobbyist using your gaming rig to earn a bit of crypto on the side, profitability has definitely slipped. In fact, all of the top mineable cryptocurrencies are currently unprofitable unless you have access to either free or dirt-cheap electricity.

If you’re still looking to do some speculative mining (after all, it’s always possible, albeit unlikely, that you’ll strike gold), here are the best cryptocurrencies to target post-ETH merge.

Note that the actual profitability of any given crypto varies depending on your graphics card’s power consumption, hashing power, and the specific settings you use, as well as your electricity costs. Consequently, this isn’t necessarily a list of the most profitable cryptocurrencies, rather those we think hold the most long-term potential. Since profitability for all coins are currently negative, we see no reason to target current profitability.

Pros and Cons of Mining Cryptocurrency

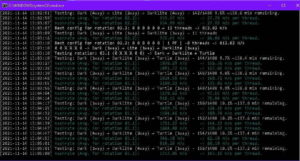

Crypto mining is widely frowned upon in PC gaming and hardware communities. This is mainly due to the fact that large-scale mining operations like the one shown below are largely to blame for the recently-ended graphics card shortage.

The widespread “mining is bad” attitude is a massive oversimplification of the problem, though. Mining itself is not problematic, it only becomes an issue when you buy GPUs for the purpose of mining, thus reducing the supply available to others. If you already have a gaming PC equipped with a high-powered graphics card, you may find it beneficial to mine.

Benefits of Mining

Obviously the main benefit reaped from mining is in the form of financial gain. If you mined Ethereum, for example, you were rewarded in the Ethereum token which you could sell for fiat (traditional money) or hold in the hopes of price appreciation. If you’ve already purchased the graphics card for the purpose of gaming, all profit from GPU mining can be considered an added bonus.

See Also: How to Mine Cryptocurrency: The Essential Guide

Downsides of Mining

On the other hand, there are a few negative aspects of mining to consider. First and foremost, mining can certainly add wear and tear to your graphics card. More specifically, mining increases GPU and VRAM temperatures which causes your graphics card fans to spin at high speeds in an attempt to cool down. Having your fans running at full throttle 24/7 will decrease the lifespan of your graphics card.

To work around this we recommend optimizing your GPU settings for mining. This typically involves reducing the core clock speed, increasing your memory clock, decreasing your power limit, and setting your fan to a constant speed somewhere between 70 and 85%. This will diminish the negative impacts of mining while still allowing you to earn substantial profits.

Graphics cards also put off a significant amount of heat when mining. In the winter this is rarely an issue but in warmer seasons you may find that the room where your PC is housed becomes uncomfortably hot due to mining. If this is problematic for you it may be best to avoid mining during the summer or spring.

Lastly, mining cryptocurrency does require power. Unless your electricity is extremely expensive you’ll still be turning a profit as long as you choose the right crypto, but it’s important to understand and factor in the cost.

The 6 Best Cryptocurrencies to GPU Mine

5. Ravencoin

An exceptionally popular CPU-mineable coin in the past, Ravencoin utilizes the KawPow hashing algorithm and is considered one of the better-established POW cryptocurrencies; as of 9/20/2022 it ranks 81st by market cap, with a fully diluted market cap of $807.5 million.

For this reason, RVN’s potential for price appreciation is a lot lower than that of many alternative projects, making it more of a “safe play.” If the cryptocurrency market sees a heavy rebound Ravencoin miners would stand to reap a solid return, whereas mining a smaller-cap coin presents a lower probability of returns with higher upside.

4. Ergo

Ergo runs on the Autolykos algorithm and is one of the more speculative cryptocurrencies on this list. In other words, if you choose to mine Ergo you’re best off holding for the long-term since it’s currently less profitable than several other projects.

With a current market cap of $158 million, ERG has plenty of room to grow and is unique in that it uses less electricity than most projects on different algorithms. It also charges no gas fees, offering a large advantage over Ethereum’s extremely expensive cost per transaction. You can read more about Ergo here.

3. Firo

Formerly known as Zcoin, Firo is a privacy-focused cryptocurrency that’s still relatively tiny. It’s currently the fifth most profitable cryptocurrency to mine, and its current market cap of $63 million leaves a lot of upside for long-term holders. FIRO uses its unique FiroPOW algorithm, and more can be earned by staking to Masternodes once your balance reaches 1000 FIRO.

2. Flux

Flux presents a fascinating concept, as it aims to be what’s essentially a decentralized AWS or Google Cloud-type service. They provide cloud infrastructure for deploying dApps, with rewards split between nodes and miners. FLUX has a current market cap of $330 million so it’s still a small-to-medium-scale project with a lot of appreciation upside, should it gain popularity.

Even if the price and network difficulty were to remain constant FLUX isn’t a bad expenditure of resources, as it’s currently the fourth-most profitable crypto to GPU-mine.

1. Super Zero

Super Zero is yet another privacy-focused project, and it allows complete transactional anonymity through the use of Super-ZK encryption. At the time of writing it’s second to only Ethereum in terms of profitability, and with a market cap of less than $30 million it’s an incredible 1/15,200 the size of Ethereum.

If you don’t need the money immediately and want to increase potential gains, SERO is by far the best option to mine at the moment. Privacy above and beyond the standard blockchain is a growing niche in crypto and appears to be here to stay. If it continues to grow SERO and its miners would be beneficiaries. Feel free to check out our guide to mining SERO for more information.